What Does It Take to Get a Credit Card

Applying for a credit card is as simple as entering your information into an online form and clicking "submit." But getting approved for a credit card? For some, it requires a little know-how and planning before applying.

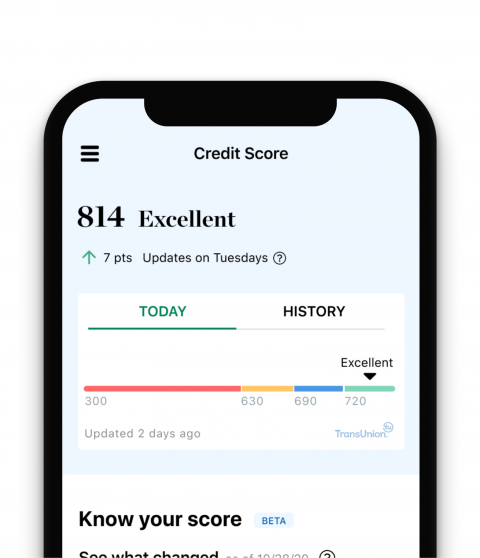

Find the best card for your credit

Check your score anytime, and NerdWallet will show you which credit cards make the most sense.

1. Know about credit scores

Credit scores — you have many — are one of the most important factors in a credit card issuer's decision to approve your application. Banks differ on how they make approvals, but scores are typically classified by lenders like this:

Most rewards credit cards require good or excellent credit. So if you've struggled to maintain a good credit history, you might want to delay applying until your credit improves. Or, instead of rewards cards, you could consider secured cards or cards designed for people with bad credit .

2. Access your credit scores

You can pay to get your FICO score from MyFICO.com, but if you already have a credit card account, you may also already have access to free FICO scores on your monthly statement or online account. And Discover, an issuer of credit cards, offers a free FICO score to everybody, even if you're not a customer.

Some personal finance websites, including NerdWallet, offer a free credit score from VantageScore. VantageScores and FICO scores track similarly because both weigh much the same factors and use the same data from the credit bureaus.

The list is here.

See 2021's best credit cards for cash back, rewards and more. All backed by tons of nerdy research.

3. Improve your credit

Your credit scores will rise if you:

-

Make payments on time.

-

Keep balances low on existing credit cards.

-

Avoid new debt.

A full 30% of your credit score is determined by how much you owe. High credit card balances can be especially damaging. Your credit utilization ratio — your balance divided by your credit limit — should be below 30% on each credit card. For example, if you have a credit limit of $10,000, it's recommended to keep the balance below $3,000.

Lower your credit utilization by creating a plan to pay down an existing balance as quickly as possible. And consider paying off purchases more than once a month to keep your balance lower throughout the month.

4. Don't apply for the first offer you see

If you have bad credit, you may not get approved for a card with a large sign-up bonus and lucrative rewards. Each credit card application can temporarily ding your credit report, so consider using an online tool to pre-qualify .

You can also call the card issuer and ask about a specific card's requirements.

You may have an easier time getting approved for a secured credit card, which uses a cash deposit you make upon approval to "secure" your line of credit. Some of the best secured cards offer cash rewards, flexible deposit amounts, and the chance to upgrade to an unsecured card (and get your deposit back).

5. Include all income in the application

Issuers consider your credit scores an indicator of creditworthiness, but scores don't reflect your income. Card issuers use income to calculate your debt-to-income ratio , which helps determine your ability to make payments. Change your ratio by either increasing income or decreasing debt.

If you earn money outside your full-time job, include it on your application. As long as you're 21 or older, you can include your household income, including income from your spouse or partner , on your credit card application.

Resist the temptation to overstate your income. If an issuer finds that you knowingly provided false information on your application, you could be charged and convicted of credit card fraud.

Being unemployed doesn't automatically disqualify you from getting a credit card.

6. Don't give up

Have a plan before you call. You have the right to ask the issuer why you were denied, and you can also check your free credit report at AnnualCreditReport.com to see if there are any blemishes on your history. Formulate a convincing argument for why you want the card and why you are fiscally responsible. Be polite. Customer service agents are more likely to respond positively if you have a pleasant demeanor.

Still no luck? Waiting about six months between credit card applications can increase your chances of getting approved.

The bottom line

That's why it's essential to take stock of your credit situation before you apply for your next card and to choose the best card .

Also, give accurate information during the application process and be prepared to make a case for yourself in the event you aren't approved immediately.

What Does It Take to Get a Credit Card

Source: https://www.nerdwallet.com/article/credit-cards/apply-for-a-credit-card

0 Response to "What Does It Take to Get a Credit Card"

Post a Comment